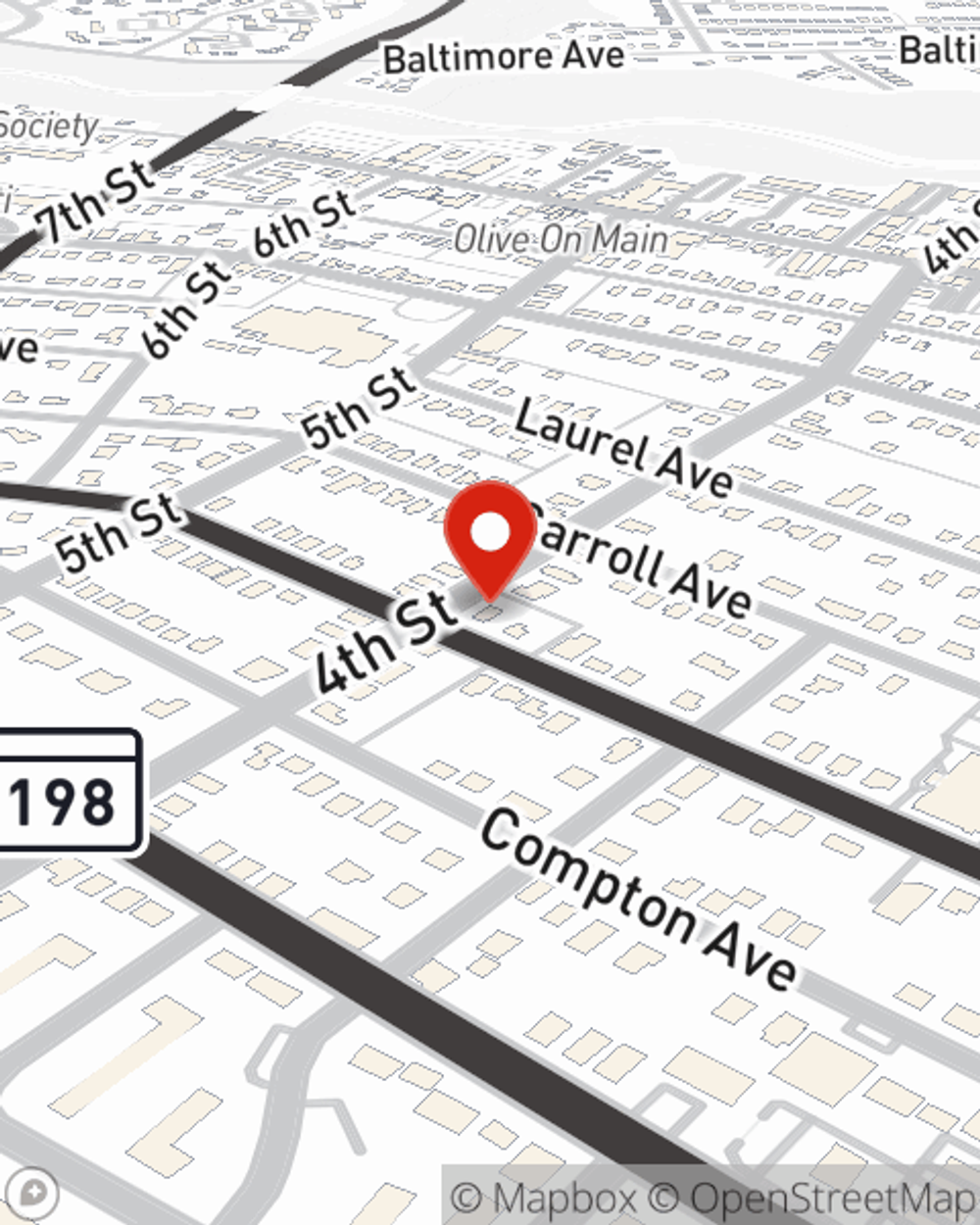

Renters Insurance in and around Laurel

Welcome, home & apartment renters of Laurel!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your tablet to your coffee maker. Wondering how much coverage you need? Not to worry! Kathy Fowler is here to help you consider your liabilities and help pick the appropriate policy today.

Welcome, home & apartment renters of Laurel!

Renting a home? Insure what you own.

Safeguard Your Personal Assets

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

More renters choose State Farm® for their renters insurance over any other insurer. Laurel renters, are you ready to talk about the advantages of choosing State Farm? Reach out to State Farm Agent Kathy Fowler today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Kathy at (301) 369-0507 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Kathy Fowler

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.