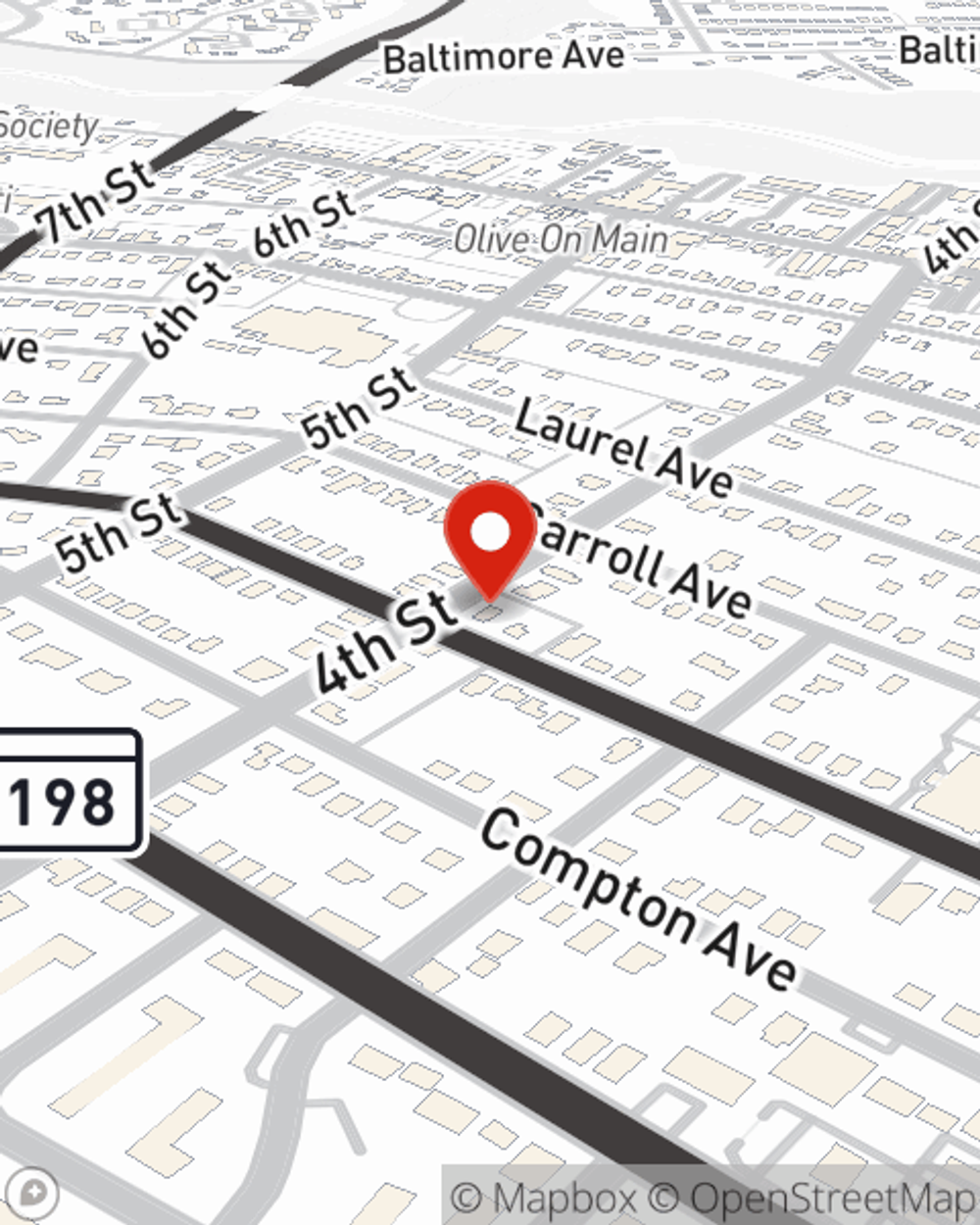

Business Insurance in and around Laurel

Get your Laurel business covered, right here!

This small business insurance is not risky

Insure The Business You've Built.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Problems happen, like a customer hurts themselves on your property.

Get your Laurel business covered, right here!

This small business insurance is not risky

Keep Your Business Secure

Protecting your business from these potential accidents is as easy as choosing State Farm. With this small business insurance, agent Kathy Fowler can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Eager to explore the specific options that may be right for you and your small business? Simply reach out to State Farm agent Kathy Fowler today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Kathy Fowler

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.